The Saudi economy also performed well in 2021, driven by growth in the non-oil sector and higher oil prices.

Global economy

In 2021, the COVID-19 pandemic and its containment was a key determinant of the economic performance worldwide, just as it was in 2020. The International Monetary Fund in its World Economic Outlook (WEO) Report, January 2022, estimated global economic growth at 5.9% for 2021, reflecting the contraction in 2020.

However, growth was expected to be highly divergent across different groups of countries.

COVID-19 deaths saw a reduction towards the latter part of the year. While vaccination rates have been uneven across countries, rollout has certainly played a role. However the emergence of the Omicron variant in late November threatens to retard recovery.

Projected growth rates of major countries and regions

| Country/Region | GDP Growth | ||

|

2022 (%) |

2021 (%) |

2020 (%) |

|

| World | 4.4 | 5.9 | -3.1 |

| The United States | 4.0 | 5.6 | -3.4 |

| Euro Area | 3.9 | 5.2 | -6.4 |

| Japan | 3.3 | 1.6 | -4.5 |

| The United Kingdom | 4.7 | 7.2 | -9.4 |

| China | 4.8 | 8.1 | 2.3 |

| India | 9.3 | 9.0 | -7.3 |

| Russia | 2.8 | 4.5 | 2.7 |

| Middle East and Central Asia | 4.3 | 4.2 | -2.8 |

Source: World Economic Outlook, January 2022

Projected Growth rates by economic categories| 2022 | 2021 | 2020 | |

| Advanced economies | 3.9 | 5.0 | -4.5 |

| Emerging market and middle income economies | 4.8 | 6.5 | -2.0 |

| Low income developing countries | 5.3 | 3.1 | 0.1 |

Source: World Economic Outlook, January 2022

In advanced countries, fiscal and monetary policies have been enacted to alleviate the impact of the pandemic. In a development unprecedented in several decades, fiscal and monetary policies are working in lockstep to combat the crisis.

Global growth is projected at 5.9% in 2022, according to the WEO Report. For advanced economies, it is projected at 5.0%, while in emerging market and developing economies, it is projected at 6.5%. Some emerging economies, such as India, performed exceptionally well, despite headwinds. However, the recovery is expected to be uneven and standards of living, even in some developed countries, are expected to be lower than pre-pandemic levels. The biggest factor affecting the reliability of the forecasts is China. It is the biggest driver of economic growth, expected to account for about 30% of total growth in 2021. If the Chinese economy falters, it will have a major impact globally.

The WEO Report points out that with improving economic conditions and health conditions, governments should move away from emergency support to more targeted measures. Global debt is a rising concern with total debt increasing to nearly USD 300 Tn in June 2021.

Stock markets

Despite the COVID-19 crisis, stock exchanges on the whole performed remarkably well in 2020. After the initial crash, stimulus measures and development of vaccines sent markets on an upward curve and all three major indices (the S&P 500, the Dow Jones, and the Nasdaq) registered double digit growth in 2021. Furthermore, all three indices have shown similar returns. What is more impressive is that stocks from diverse sectors have performed well.

However, by September there were signs of unease, mainly due to fears of the spread of the Delta variant and by November due to the Omicron variant. There was a shift towards defensive investments, which are less affected by swings in the global economic cycle. It is significant that high tech stocks, which boomed at the height of the pandemic, are doing well again.

Saudi economy

After a contraction of 4.1% in 2020, the Saudi economy is expected to record a growth of 2.9% in 2021. This is partly driven by a strong growth in the non-oil sector. Many non-oil subsectors have expanded, consequent to the relaxation of COVID-19 related restrictions enabled by vaccine rollout, and return of consumer and business confidence. Higher oil prices have been another contributory cause. The Kingdom aspires to diversify the economy and reduce dependence on oil and its derivatives under its Vision 2030 plan.

The Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund, is playing a transformative role in the Saudi economy, and is spearheading the effort to realize the goals of Vision 2030. The PIF has created more than 30 companies across 10 sectors. Some of these companies operate in sectors that are new to the Saudi economy, and thereby promote diversification. The sectors include renewable energy, desalination, tourism, entertainment, real estate, logistics, and IT. A sector that is showing strong growth is real estate; this aligns with the Vision 2030 goals of increasing home ownership to 70%. The ventures initiated by the PIF have generated 331,000 direct and indirect employment opportunities.

Total public revenues, which are estimated at SAR 930 Bn in 2021, are forecast to amount to SAR 1,045 Bn in 2022, driven by the domestic recovery and higher oil prices. The budget surplus in 2022 is forecast as SAR 90 Bn (2.5% of GDP), as against a budget deficit of SAR 85 Bn (2.7% of GDP) 2021. The public debt, which is estimated to be SAR 938 Bn in 2021, is forecast to remain the same at the end of 2022.

Export earnings increased from SAR 652 Bn in 2020 to an estimated SAR 935 Bn in 2021. With rising export earnings from oil and non-oil sectors, the Kingdom expects a current account balance of SAR 121 Bn (3.8% of GDP) in 2021. Sectors such as travel, restaurants, tourism, and entertainment are also expected to benefit from rising demand in 2021. This was driven by higher vaccination coverage and relaxation in social distancing rules.

The Saudi banking sector has weathered the COVID-19 storm relatively well. Even Western banks have seen their valuations drop sharply as a result of the pandemic. However, in the case of Saudi banks, their drop in valuations was smaller and their valuations are now close to pre-pandemic levels. Indeed, some have even exceeded it. In fact, NCB, the Kingdom’s largest bank notched its highest profit ever in 2020, despite the pandemic. Throughout the sector, the growth areas have been residential mortgages, corporate lending, and lending to the state, in that order. Residential mortgage finance has increased by a factor of 17 since 2016. Small and Medium Enterprise (SME) lending has been another growth area, supported by the Kafalah programme.

Saudi stock market

The Saudi Exchange is the largest exchange in the GCC region, and also ranks among the leading exchanges globally. The Exchange plays a pivotal role in the Saudi economy, and also plays a key role in achieving the goals of Vision 2030. The exchange has been included in three leading global emerging market Indexes; FTSE Russel, MSCI, and S&P. It is also an affiliate member of the International Organization of Securities Commissions (IOSCO), the World Federation of Exchanges (WFE), and the Arab Federation of Exchanges (AFE).

Market performance – 2021

| Main Market |

Percentage

increase over 2020 (%) |

Nomu Market |

Percentage

increase over 2020 (%) |

| TASI | 29.83 | Nomu C Index | -1.03 |

| Market capitalization | 9.97 | Market capitalization | 56.24 |

| Value of shares traded | 7.09 | Value of shares traded | 59.76 |

Where we stand

Number of qualified foreign investors

| 2020 | 2,333 |

| 2021 | 2,658 |

IPOs and new listings

| Main Market | |

| New listings | 9 |

| IPOs | 9 |

| Nomu | |

| IPOs | 6 |

| New listings | 11 |

Saudi economy – future outlook

In its pre-budget statement, the Saudi Ministry of Finance forecasted a growth in real GDP of 7.5% for 2022, based on the assumption that economic activity will normalize, which would support a healthy growth in the non-oil sector. The Kingdom’s balance of trade is also expected to improve, as indicated by the positive development in 2021. This is in addition to growth in the oil sector, driven by the anticipated increase in the Kingdom’s production starting in 2022, according to the OPEC+ agreement, and also by the stabilization in global demand.

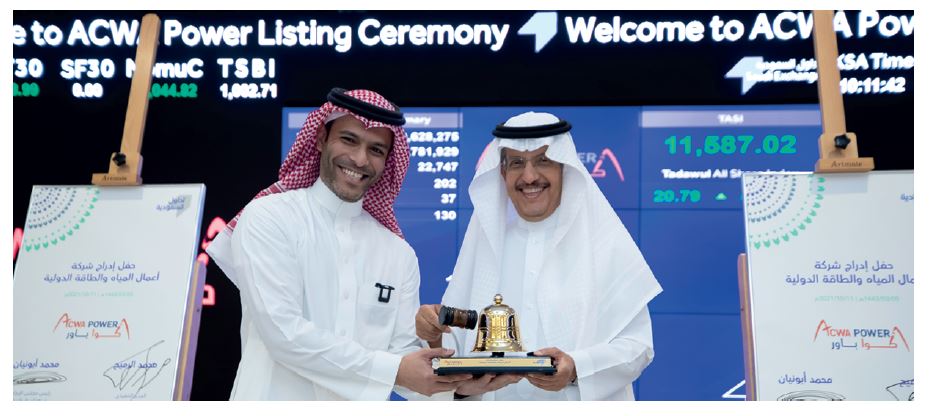

Listing ceremony of Aqwa Power

Listing ceremony of Burgerizzer

Listing ceremony of Tanmiah Food Co.

The Government aims to sustain the spending ceilings approved last year for the medium-term and expenditure is projected to reach approximately SAR 955 Bn for FY 2022 and SAR 951 Bn in FY 2024. This is in addition to continued investments in mega projects and Vision Realization Programs (VRPs) in order to achieve the Saudi Vision 2030 goals. More opportunities will also be given to development funds and the private sector to participate in leading investment opportunities, privatization projects, and infrastructure development projects.

Meanwhile, the Kingdom’s public debt is anticipated to remain the current figure of SAR 938 Bn, or 25.9% of GDP, in 2022. Saudi Arabia’s public debt to GDP ratio remains significantly below that of advanced economies, European countries, and other Middle Eastern countries. This is a trend that is expected to continue in the future. A total of SAR 96 Bn in new Government Debt has been issued during the year under review. This has been sufficient to bridge the fiscal deficit, eliminating the need to draw on Government deposits held at the Saudi Central Bank.

A budget surplus of SAR 90 Bn is projected in 2022 and surpluses are expected to continue into subsequent years. Budget surpluses will be used to enhance Government reserves, as well as supporting development funds, while new debt issuances will be directed towards the repayment of principals. The annual borrowing plan is being formulated in the context of a medium-term debt strategy. In the medium term, public debt levels are expected to remain constant. Government deposits at the Saudi Central Bank are expected to exceed initial projections in 2022 and continue to grow, due to expected surpluses in 2023 and 2024.