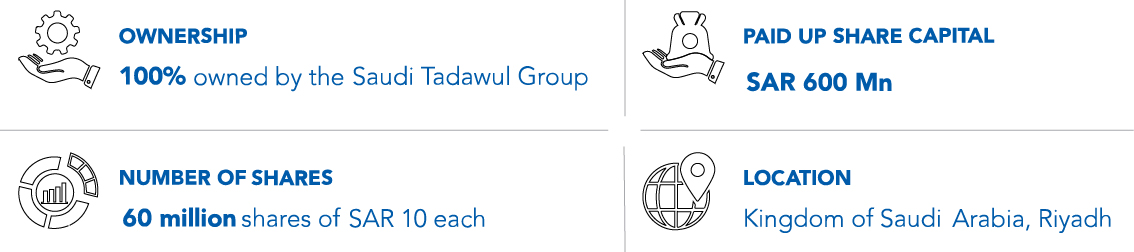

Muqassa is the clearing house of the Saudi Exchange. It works to reduce post-trade risk, provide a centralized counterparty risk management service and develop clearing services in accordance with international best practices.

VISION

TO BE A LEADING CLEARING HOUSE THAT FOSTERS FINANCIAL MARKET STABILITY.

MISSION

TO PROVIDE RELIABLE, EFFICIENT AND INNOVATIVE CLEARING SERVICES.

Key Activities and Services

- Central counterparty clearing services for all securities traded on the Saudi Exchange (Equities, Sukuk and Bonds, ETFs, REITs)

- Central counterparty clearing services for all securities traded on Derivatives Market

- Repo clearing services

Muqassa is one of the key pillar of the Financial Sector Development Program (FSDP). Muqassa plays a significant role in developing market infrastructure to enhance market efficiency and is essential for the development of new products and services in the Saudi capital markets.

Muqassa aligned with international best practice, as its works to reduces post-trade risks by providing a centralized counterparty and clearing services in accordance with international risk management best practices that align with global capital markets.

During the year 2022, Muqassa achieved a major milestone by activating Target Operating Model on Cash Market. Having commenced these cash market operations in April 2022, as we have accomplished one of the most significant bundle of enhancements in the market, it is an achievement resting on formidable professional and technical demands in terms of infrastructure assessment and development, solutions design and market readiness testing, together with accommodation to extensive regulatory changes.

The development has yet more to it. Previously, clearing services were not provided in the market. However, since April 2022, Muqassa introduced its clearing services to cover Exchange traded products on both cash and derivatives markets as well as REPO as an OTC product.

The introduction of this new model guarantee and confirm the transactions prior to settlement between the Participants, to establish final positions for settlement. Muqassa clears exchange traded transactions on open offer basis, where Muqassa places itself between the counter parties at the time of matching.

Cash market, Repo and Single Stock Future (SSF) innovations build on our previous introduction of Index Futures (IF) clearing. As the nature of traded investment instruments expands, our services will be compatible and ready with this expansion, as we always work alongside the market and other stakeholders to obtain best practices and unique solutions.

Our commitment to implement international best practices, and responding to investor needs is also reflected through the extension of the changing the failed settled trades intended settlement date (ISD+8), which in turn, market participants will have an extension to obtain securities through the optional buy-in board. In addition to the possibility of obtaining securities from the main market and have trades settled before mandatory buy-in activated after Five business days from the intended settlement date (ISD), thus avoiding substitution and increasing the chances of delivering securities to clients effectively, which preserves the rights of all counterparties of the failed settled trade.

Turning to the Derivatives market, our role now is to work closely with Saudi Exchange and stakeholders to seek and create enhancements in the market, as the derivatives market operations are now fully operated by Muqassa, after it was fully operated by NASDAQ in 2020. We are sure that there are many opportunities available for market development, as we work to provide market needs and the necessary attention to all products and services, which achieve and enhance added value.

It will be seen that a close understanding of Group objectives, and a close relationship with the Exchange is crucial to our role. Working side by side with the Exchange, our role at Muqassa required enhanced systems, methodologies and models in order to monitor trading management, the obligations of the members, and to cover counterparty risk. In each case, and in those yet to come, products are not to be activated in the market unless Muqassa is ready to clear them.

Costs are of central concern to us. In the areas of cash and securities release, the cost opportunities rest on the way we do the netting, and this will release some liquidity to the market. In terms of investor costs, we are determined to have the value of new services outweigh cost issues.

As demonstrated in reported activities, our working environment is fast paced. It is an environment we thrive in, identifying, accepting and meeting the challenges of an ever-growing, ever-enhanced capital market. Members and investors too face new challenges with new introductions. We dedicated our efforts to serve and support members in terms dealing with margins, trading limits, collaterals and other challenges as they emerge in members’ operations.

Notably, in terms of operational efficiency, Muqassa has been able to develop and introduce its operations in these functions without requiring any major changes on its organization structure.

In staff training, we are part of all development plans concerning the Group as a whole, and include these plans in our annual training programs. We are highly fortunate in the scale and strength of our own in-house expertise, and emphasize day-to-day learning and upskilling via shared information and experience among our teams. Additionally, working side by side with NASDAQ and set of experts in the market, our local teams obtain first-hand externally experienced, and sector knowledge from experienced professionals.

We grow steadily together with the Group, and actively contribute to Group growth as a whole.