The Saudi Exchange conducts listing and trading in securities for local and international investors. The Exchange is instrumental to achieving the long-term growth plans for the Group and providing market participants with attractive and diversified investment opportunities.

VISION

SHAPING THE DEVELOPMENTS OF THE SAUDI CAPITAL MARKET BY PROVIDING BEST-IN-CLASS FINANCIAL INSTRUMENTS ACROSS ALL ASSET CLASSES, SUPPORTED BY A STRONG, INNOVATIVE AND TECHNOLOGICALLY ADVANCED MARKET INFRASTRUCTURE.

MISSION

PROVIDING A MARKET THAT IS RELIABLE, RESILIENT, TRANSPARENT AND EFFICIENT, WHILE PROTECTING MARKET PARTICIPANTS AND OFFERING TAILORED SERVICES THAT ARE ATTRACTIVE TO DOMESTIC AND INTERNATIONAL STAKEHOLDERS.

Key Activities and Services

- Providing listing services

- Providing order matching and trading services

- Providing market information and indices

As the only entity licensed to act as Saudi Arabia’s securities exchange, we have a significant role to play in the fulfillment of the Kingdom’s Vision 2030. It is a role in which we adhere to, and exhibit, the highest professional principles, as we strive to develop the Saudi capital market into a technologically advanced, diverse and integrated capital market.

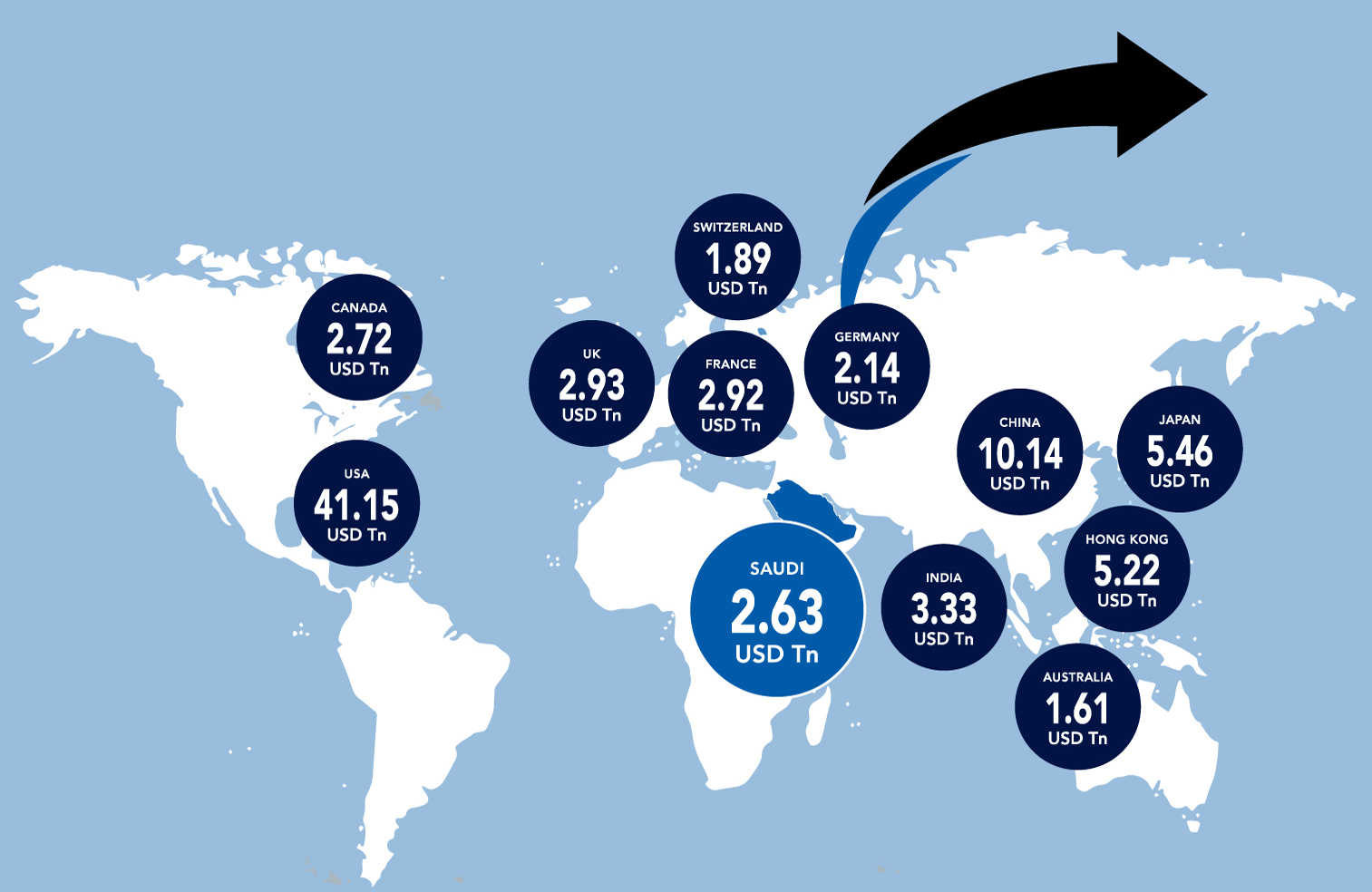

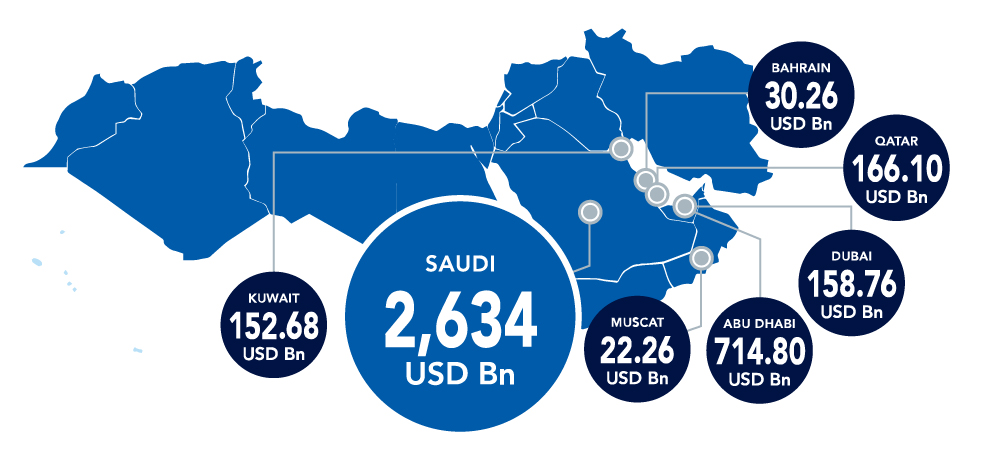

The Exchange ranks 9th among the world’s stock exchanges in terms of market capitalization*

All statistics above are as of December 2022.

Source: Bloomberg

*Market capitalization represents the combined capitalization of the listed companies in the respective exchanges.

The Exchange accounts for 67.90% of the total market capitalization of Middle East stock exchanges

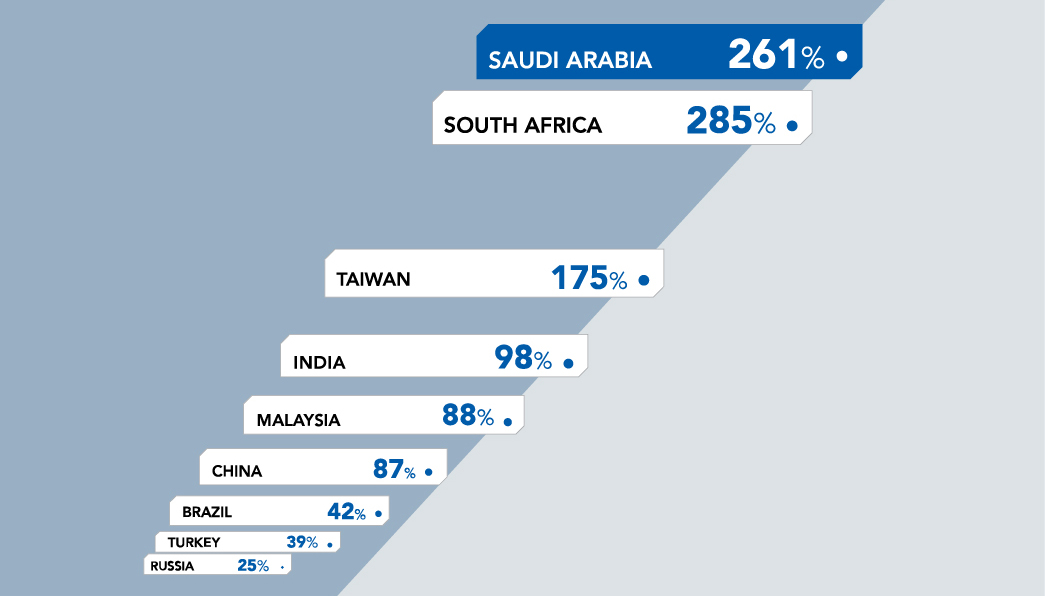

The Exchange has the highest market capitalization to GDP ratio among leading emerging markets

With the transformation of the Saudi Tadawul Group into a holdings structure, the Saudi Exchange was established in 2021 as a dedicated stock exchange, to list and trade a wide range of securities and provide indispensable market information to all relevant stakeholders. Our main operations include managing the Exchange, providing trading platforms for listed securities as well as suspended listed companies and unlisted debt, providing listed companies access to financing, and allowing investors to invest in securities listed on the Exchange.

The Exchange comprises two platforms; the Main Market – with the Tadawul All Share Index (TASI) as its primary index, and Nomu – a parallel equity market with lighter listing requirements than the Main Market, with the Parallel Market Capped Index (NomuC) as its headline index. The debt market includes bonds and Sukuk for corporate and sovereign issuances with several indices such as the Tadawul Sukuk and Bonds Index, while the Funds include several listed ETFs, CEFs and REITs. The Derivatives Market was launched with Index Futures in 2020 as a key initiative of the Financial Sector Development Plan (FSDP) under the Kingdom’s Vision 2030. In Q3 2022, Single Stock Futures (SSFs) were launched.

The Exchange continues to increase foreign participation as part of the FSDP’s primary objectives in the formation of an advanced capital market in line with Vision 2030, supported by the achievement of numerous other goals such as the inclusion in the MSCI Emerging Markets Index, the FTSE Russel Emerging Markets Index, and the S&P Dow Jones Emerging Markets Index.

Cash markets

With the benefit of strong capital inflows and associated capital market activity across the region, we worked within an environment that was positive for our business performance during 2022, despite developments in the geopolitical climate and global macroeconomic policies that influenced investor sentiments.

Our driving mission is to create and capture value where we identify it, a purpose we strongly aligned with throughout 2022 with a number of market developments.

Key Market Developments in 2022:

Enhancements made to the post-trade infrastructure

The largest in the history of the market

Introduction of dual listing

The first concurrent IPO and dual listing in Saudi Exchange

Derivatives market development

Single Stock Futures were launched in Q3 on 10 underlying companies

Launch of market-making framework for equity and derivative markets

To deepen order book liquidity

Listing of the largest Tier I Sukuk Issuance and the first of its kind

Providing new investment opportunities, especially for retail investors

Listing of the first tradable fund in Nomu – Parallel Market

Increasing diversification and deepening the Saudi capital market

Key among these developments were the enhancements made to our post trade infrastructure, implemented as part of the Post-Trade Technology Program (PTTP). Such advanced infrastructure improvements signal our determination to create an attractive investment environment conducive to the needs of domestic and international investors, and well aligned with global best practices.

The series of enhancements were the largest in the history of the Saudi capital market, and intends to provide investors with increased investment opportunities and access to a diverse range of financial instruments and new products. The major enhancements that were successfully implemented during 2022 included the introduction of a highly efficient handling of order flow by market participants. Further, enhancements include same day settlements for buy-in trades, flexible settlement cycles for negotiated deals, and additional flexibility in the trading experience and settlement cycles for securities traded over-the-counter (OTC), where trading is constrained to unlisted debt instruments and listed but suspended equities.

2022 also saw the introduction of a market-making framework (MMF) for our equity and derivatives markets, to deepen order book liquidity and increase price formation efficiencies. Under these new market-making regulations approved by the Capital Market Authority (CMA), entities interested in registering as market makers are required to be exchange members, and may act in the capacity of principal on their own account, or as an agent on behalf of a client. These market makers must provide continuous buy and sell orders for a listed security during market open sessions, for the purpose of providing liquidity for the relevant listed security. A list of market makers and the securities on which they are performing this activity is set to be published on the Exchange website. We will continue to monitor all market makers for compliance with their specified obligations, and provide incentives once such obligations are met.

In 2022, we debuted the first concurrent IPO and dual listing of a non-Saudi company on the Saudi Exchange. The listing of 2.6 billion shares on the Saudi Exchange and Abu Dhabi Securities Exchange (ADX) raised SAR 6.7 Bn in gross proceeds, its successful conclusion encouraging non-Saudi issuers to list on the Saudi Exchange.

Two more partnerships were formalized with regional exchanges during 2022 to enable dual listings; we entered into an agreement with Muscat Stock Exchange (MSX), and also signed a Memorandum of Understanding (MoU) with Boursa Kuwait to enable dual listings, and explore collaboration opportunities in investor relations initiatives as well as in FinTech.

These agreements resulted from the engagements, substantial discussions and developments with regional and international exchanges. The goal of these partnerships is to explore a new era of opportunities, and exchange mutual benefits and experiences across our operations. Apart from the strong bonds that have been established with GCC exchanges, we also continue to build partnerships with international exchanges such as:

- AIX – Astana International Exchange

- EGX – The Egyptian Exchange

- HKEX – The Stock Exchange of Hong Kong Limited

- NYSE – The New York Stock Exchange

- SGX – The Singapore Exchange

We remain highly alert to our operating environment, and exert every effort to align with global best practice, or enhancement implemented among any of our traded products and services.

Looking to the coming years in terms of the Main Market and Nomu, our strategic and practical focus can be broadly categorized in the following three areas:

- Continued development of debt markets and traded funds through product and service enhancements, raising investor awareness and introducing initiatives targeted towards increasing market liquidity and enhancing overall trading.

- Continued enhancement to our equity market microstructure to advance overall market efficiency and liquidity.

- Opportune, practical and sustainable expansion of our overall market-wide products and services.

Listed and Registered Securities

| Market |

Number of listed securities |

Note |

| Main Market | 206 | Excluding REITs |

| Nomu Market | 45 | Excluding 1 REIT |

| REITs | 18 |

17 listed in Main Market and 1 listed in Nomu |

| CEFs | 2 | |

| ETFs | 7 | |

| Sukuk and Bonds | 74 | 4 Corporate and 70 Government |

Listed and registered securities across cash markets

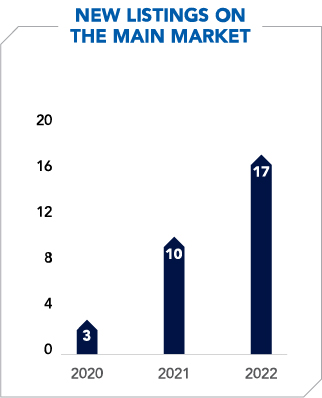

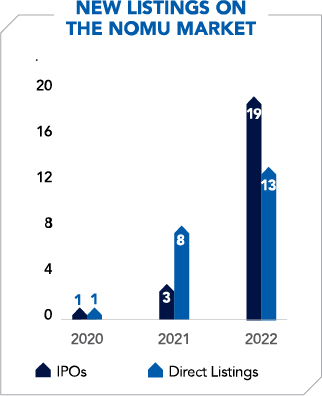

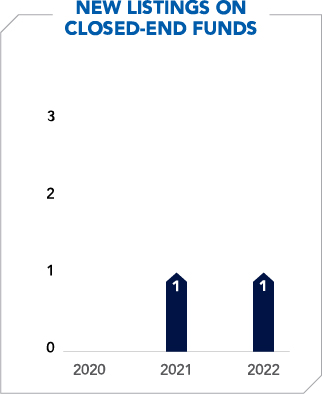

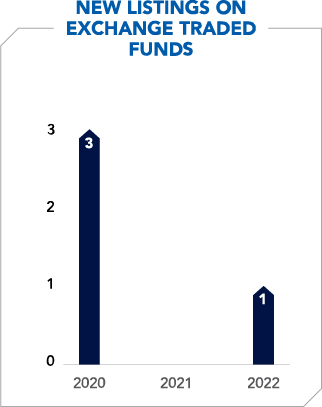

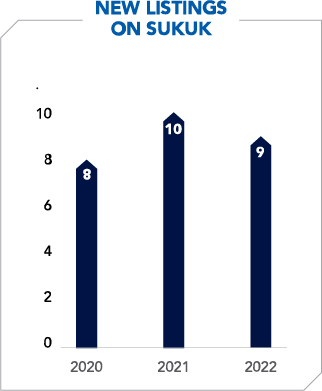

The growth in IPOs and new listing numbers in the Main Market, Nomu (with direct listing), in traded funds and in debt instruments, is a strong demonstration of our strategic achievement:

New listing numbers for traded funds (registered mutual funds, ETFs and CEFs), and debt instruments (government and corporate Sukuks and bonds) remain relatively steady:

Turning to our progress in corporate Sukuk and bonds, we are pleased to report demonstrable highlights in the new listing of Al Rajhi Bank’s Tier 1 Sukuk denominated in Saudi Riyals – the first of its kind, with the debt issuance achieving record numbers that were the largest in the history of the Saudi Sukuk market.

In terms of REITs, while the last REIT was listed in 2019, we received approval from the CMA to list one REIT each on the Main and Parallel Markets during 2022, with the Al Waha REIT Fund becoming the first tradable fund listed and traded on the Nomu Parallel Market in 2022.

Growth in Capital Raised Through IPOs and Rights Issues for Main Market

| Capital Raised (SAR) | ||||

| Year | 2020 | 2021 | 2022 | Comments |

| Main Market | 5,254,440,000 | 17,179,160,744 | 37,512,544,092 | Including REITs |

| Nomu – Parallel Market | 180,000,000 | 1,893,469,550 | 1,289,992,376 | |

| Tradable Rights | 5,646,768,800 | 2,180,379,110 | 11,752,284,640 | |

Statistics on the growth in total market capitalization for Main Market, Nomu, traded funds and debt instruments (Sukuks and bonds) are as follows:

| Market Cap (SAR) | ||||

| Year | 2020 | 2021 |

|

Comments |

| Main Market | 9,101,812,814,628 | 10,009,151,361,041 | 9,878,101,398,976 | Including REITs |

| Nomu – Parallel Market | 12,179,300,000 | 19,025,273,000 | 35,085,565,047 | |

| CEFs | – | 409,930,345 | 850,324,747 | |

| ETFs | 1,608,258,900 | 1,597,731,800 | 1,503,387,900 | |

| Sukuk and Bonds | 387,840,399,020 | 461,370,215,860 | 525,316,925,120 | Issuance Size |

We pay close attention to a range of suitable entities – from large companies to energetic family enterprises – for whom we believe listing offers measurable value, and ensure we follow up with the needed encouragement and proven results to assure potential customers of long-term value creation.

Saudi Exchange conducted 30 workshops and visited 752 companies during 2022, to increase their understanding of, and responsiveness to, listing on the Exchange. We provide a frank and detailed discussion in our workshops and visits, covering areas of interest as well as the benefits and considerations of listing, listing requirements, types of listings, and listing incentives.

With regard to listing incentives during 2022, through the Encourage Listing Program (ELP) which falls under the Financial Sector Development Program (FSDP) and in cooperation with 14 different governmental entities, 21 incentives were launched to give a preferential advantage to listed companies. These incentives varied according to the entity that provides the incentive, and were divided into two main categories:

- Pivotal incentives, represented in raising the funding ceiling provided by government funds such as the Industrial Development Fund, Agricultural Development Fund, and Project Support Fund.

- Procedural incentives, represented in facilitating some government procedures such as the process of granting quick approvals for the registration of foreign partners by the Ministry of Investment.

In addition, MOUs have been signed with the following three local entities during the year:

- The Communication and Financial Knowledge Center (CFKC), in order to raise awareness about listing among a targeted public audience.

- The Princess Noura Bint Abdulrahman University (PNU), which will raise awareness about listing among students.

- The Ministry of Municipal, Rural Affairs and Housing (MoMRAH), providing informed and detailed encouragement to appropriate companies to list on the Saudi capital market.

We see expanding capital markets activity across the GCC in both the primary and secondary markets. Saudi Exchange accounts for a significant share of this activity with 51 listings and over USD 10.8 Bn in capital raised (excluding government Sukuk/Bonds) during 2022, maintaining our leadership position in IPO issuances not only in the immediate GCC, but also the Europe, Middle East and Africa (EMEA) region.

As the Exchange further attracts non-Saudi issuers, we gain additional diversification in the market, and substantially increase the global standing of the region as a leading global capital markets center.

Market information

Throughout 2022, we have pursued and implemented numerous infrastructural developments to ensure the smooth transition of Market data – an essential area of activity for the Exchange. These developments focused mainly on post-trade, and connecting members and data vendors to the new data center in King Abdullah Financial District (KAFD).

From a total of 238 clients that include Data Vendors, Members, Asset Managers, Index Providers, and Issuers, 45 were signed in 2022, expanding the Market Information client base on local and global levels.

Our Market Information and Indices Division is working on various products and services that are expected to be developed and introduced during the coming year.

On the data side, there are a number of initiatives expected to be delivered next year. Market Data Full Orderbook will offer investors and High Frequency Traders with more insights within the trading session covering historical Tick Data movements. In addition, more tools will be made available for market participants to access historical data covering corporate actions, financial statements, reference data, and other data sets through APIs.

On the indices side, Market Size and IPO indices are currently under development and expected to be launched in 2023. Moreover, we are working closely with number of asset managers on multiple customized indices that will be used as a basis for ETFs and other financial products.

Client relation development

We anticipate further interactions and increased activity with the international investment community in 2023, especially in light of the high-value IPO pipeline. We aim to broaden our reach next year and approach investors from the US and Asia Pacific, among other regions.

Our amplified efforts on outreach were accompanied by an increased number of events and workshops in 2022, where we participated in 11 events, 10 workshops and 1 webinar; a virtual webinar in collaboration with Nomura, to participate in a discussion targeting Japanese investors.

We also note a coming acceleration in new client segments, achieved through new programs such as market making, supported by our rapidly developing infrastructure. The Clients Relations Development Department continuously engages with other exchanges to share knowledge and experiences around departmental/functional governance and operations, as well as thematic developments such as ESG.

The launch of our ESG Disclosure Guidelines saw growing interest from issuers to further understand the benefits of ESG in stakeholder management, and has resulted in the number of companies reporting their ESG performance almost tripling since 2021. Our focus remains on guiding issuers in implementing ESG practices, and strengthening their ESG profiles and ratings for index inclusions.

ESG and sustainability initiatives in general, are detailed elsewhere in this report, as we aim to satisfy all stakeholders’ requirements and become one of the top ESG-active companies across our region, and the world.

The opening of the London Office too has been a major contributor towards building strong client relations.

We have also commenced dedicated client segment roadshows to promote new IPOs, Debt and Derivatives markets. The result of this suite of activities has been very promising, with the total number of QFIs increasing by 19% to reach 3,151 in 2022.

Derivatives

We first launched derivatives products in 2020 with the introduction of index futures to the market, and steadily expanded our product offering to launch single stock futures (SSFs) in 2022. Derivatives markets globally play a significant role in providing the opportunity for cash market investors to hedge their portfolios or do directional trading. As a nascent market, our derivatives products cater to all investor segments. Our solution is underpinned by a solid regulatory framework, as well as best-in-class trading, clearing and risk management infrastructure and technology.

In 2022, approximately 1,000 contracts collectively valued at approximately SAR 100 Mn traded in our derivatives market across all index futures and SSF contracts. The activity was predominately led by local and regional institutions. While uptake from individual investors has not materialized thus far, increasing liquidity and the participation of investor types are challenges we are well equipped to tackle. By working alongside our brokerage community, we will focus our efforts on educating investors and increasing awareness, particularly on the benefits of utilizing these products in their portfolio strategies.

We are well aware of the knowledge and experience that can be gained from global exchanges across this vertical; derivatives market gestation periods range from three to five years on average, and we see clear, beneficial examples of this in India, Turkey, and Malaysia. Through such learnings integrated into a carefully planned growth strategy, we are committed to developing our derivatives market and realizing its success.

As we look ahead in the field of derivatives to 2023 and beyond, we plan the introduction of new products and services, such as Single Stock Options with physical delivery, as well as Market Making for both Single Stock Futures and Options.

The Saudi stock market is the 9th largest stock market in the world, and is the leading market in the Gulf Cooperation Council (GCC)region. It is the 3rd largest stock market amongst its emerging market peers, with market capitalization by the end of 2022 exceeding SAR 9.8 Tn (USD 2.6 Tn).

Fast forward

Fast forward

Our development continues apace. For the coming year, we are working to provide services for high-frequency traders and algorithmic traders such as drop-copy and cancel-on-disconnect, request-for-quote functionality for negotiated deals, market making frameworks for debt and ETF markets, and enhancements in their closing price calculations. It is, as it was during 2022, a demanding portfolio of initiatives.

We have detailed and indicated numerous areas of business expansion and operational enhancement, which we hope to implement successfully as we continue our growth momentum. Such is the drive that has built, and will continue to build, our regional standing and our growing global reputation.